do you pay taxes on a leased car in texas

For a rented vehicle at the time of signing you must pay the 3 North Carolina car rental tax on the total rental payment plus all relevant vehicle registration and license plate fees. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle.

Tax On Leased Bmw In Texas Lessee S Affidavit For Motor Vehicle Use Other Than Production Of Income Ask The Hackrs Forum Leasehackr

However if you are renting the equipment to someone but you will operate the equipment you do not need to pay sales and use tax on the rental.

. Now you are buying the used car from BMWFS or the dealer whichever it. The monthly rental payments will include this additional cost which will be spread across your contract. Texas does not tax leases.

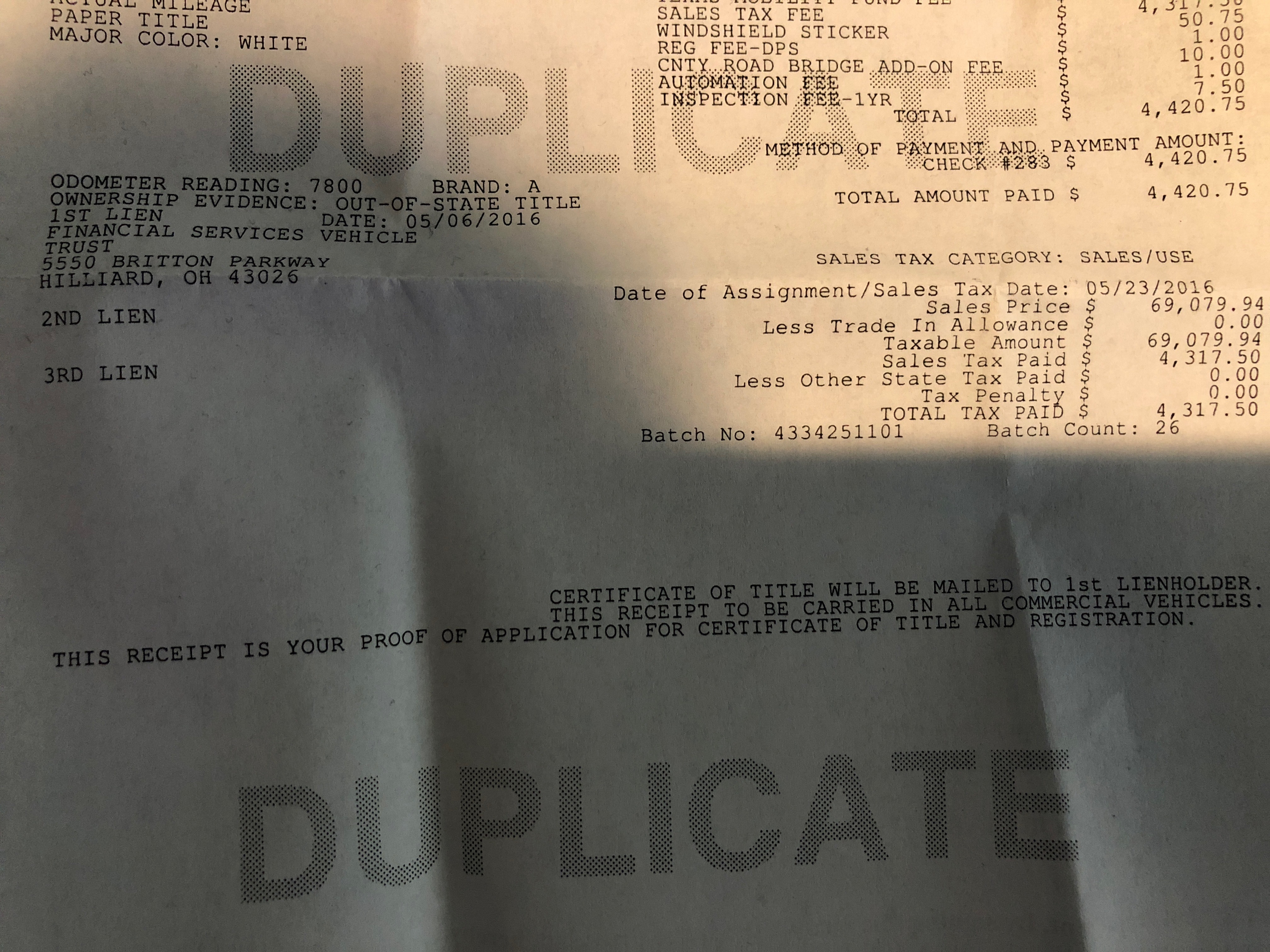

When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor vehicle sales and use tax. The standard tax.

Almost every contract has a strict cap on how many miles you can drive during the course of the lease agreement. Tax is calculated on the leasing companys purchase price. Technically BMWFS bought the car the first time and the tax was due from them they just passed the cost along to you.

In the state of Texas you pay 625 tax on Trade difference. Car youre buying 50000. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20.

Texas is the only state that still taxes the. Dear Driving for Dollars My lease is almost up and I would like to purchase the car. Do I owe tax if I bring a leased motor vehicle into Texas from another state.

Any tax paid by the renter when the motor vehicle was titled and registered in Texas was paid in the name and for the lessor. Only the service is charged tax. VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a.

The leasing company may use the fair market value deduction to reduce the vehicles taxable value. Six dollars is due to the lessor. Yes in Texas you must pay tax again when you buy your off-lease vehicle.

However if you rent out the leased equipment without operating it yourself a sales and use tax applies. Most excess mileage fees run between 15 and 50 cents per mile. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

The lease contract is not subject to tax. No tax is due on the lease payments made by the lessee. This means you only pay tax on the part of the car you lease not the entire value of the car.

Trade Difference 20000. Any rentals for less than thirty days are considered to be subject to a gross rental receipts tax at the rate of 10. Most states roll the sales tax into the monthly payment of the car lease though a few states require that all the sales tax for all your lease payments be paid upfront.

In car leasing how the sales tax is calculated and when it needs to be paid may vary from state to state. However theres one more caveat. If you dont have a trade then youre simply paying taxes on selling price.

Using our Lease Calculator we find the monthly payment 59600. Exceed that mileage limit and youll have to pay the price at the end of the lease for every mile over the cap you drive. Excess Mileage Fees.

Car youre trading 30000. This means that anybody whose vehicle would have been classed beyond band G or 151-165gkm will actually pay less from now on. Technically there are two separate transactions and Texas taxes it that way.

In addition the renter does not pay tax on the purchase of a motor vehicle for rental in Texas. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. The most common method is to tax monthly lease payments at the local sales tax rate.

In some states. In another state for the same vehicle same price and same tax. The showroom tax for the first year continues but cars with more than 0gkm will have to pay a flat rate of 140 per year after the first year.

In most states both car purchases and leases are subject to sales tax. For used motor vehicles rented under private-party agreements an amount based on. The Texas Comptroller states that payment of motor vehicle sales.

The dealership is telling me that I will need to pay sales. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. If a new Texas resident brings a rented motor vehicle to Texas the new resident owes the new 90 tax for residents.

There is also a 3 motor vehicle rental tax on vehicles leased for a period of at least 365 uninterrupted days in North Carolina. The sales tax for cars in Texas is 625 of the final sales price. If the vehicle you are purchasing has Tax Credits from the manufacturer.

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

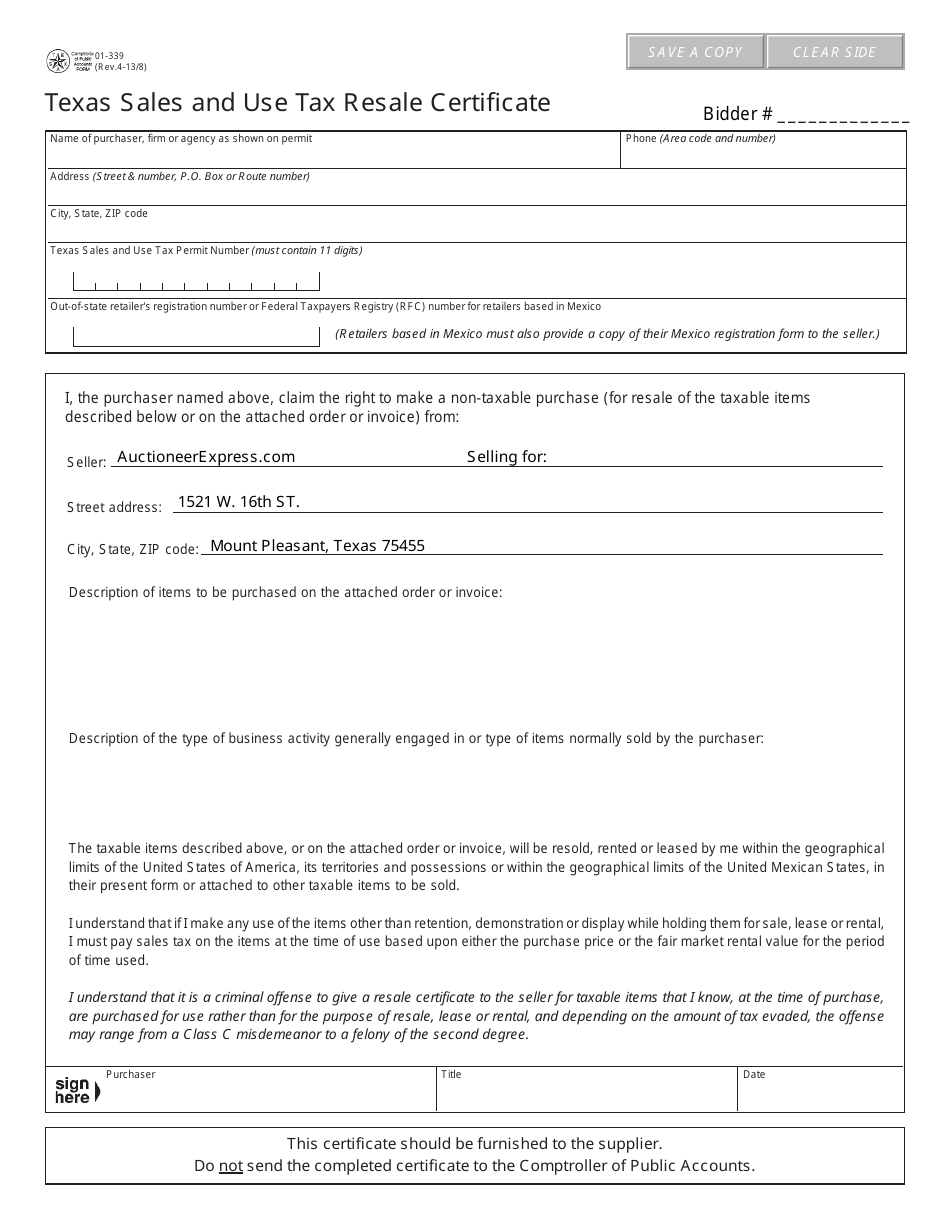

Form 01 339 Download Fillable Pdf Or Fill Online Texas Sales And Use Tax Resale Certificate Texas Templateroller

Which U S States Charge Property Taxes For Cars Mansion Global

Texas Sales And Use Tax Exemption Certificate

What S The Car Sales Tax In Each State Find The Best Car Price

Texas Car Sales Tax Everything You Need To Know

Sales Tax On Cars And Vehicles In Texas

Kurz Group Blog Texas Vehicle And Business Personal Property Tax

Property Tax On A Leased Vehicle O Connor Property Tax Experts

Just Leased Lease Real Estate Search Property For Rent

Motor Vehicle Tax Guidebook 2011 Texas Comptroller Of Public

Nj Car Sales Tax Everything You Need To Know

How Much Is Tax Title And License In Texas The Freeman Online

Commercial Lease Locators In Austin Tx Commercial Commercial Real Estate Lease

Help With Taxes In Texas Ask The Hackrs Forum Leasehackr

Lease Assumption In Texas From An Out Of State Lease Taxes Ask The Hackrs Forum Leasehackr